WHY PLAID

The most

trusted digital

finance platform

Connecting thousands of companies to millions of customers for faster, safer, and more seamless financial experiences.

All you need to onboard new customers, fight fraud, move money, and make better risk decisions

The most trusted platform

Win customers with an onboarding flow used by 1 in 3 US adults and proven to convert 23% better than competitors in a head-to-head test.

Unrivaled data network

Scale your business faster with data powered by Plaid’s network of 12,000+ financial institutions and 100+ million consumers.

Actionable insights

Get the insights you need to power secure and instant financial experiences at every stage of the customer journey.

In every head-to-head test we performed, Plaid emerged as the gold standard for data quality, security, and coverage.

Zach Smith

SVP Product at Chime

32%

Flexport offers borrowers 32% more credit

91%

Betterment boosted the median balance for 91% of users

80%

Uphold decreased return losses by 80%

Connect to a growing network of 100+ million users

Plaid enables you to tap into the industry’s largest network of banks, fintechs, and consumers. So you can onboard new customers, reduce fraud, and increase the lifetime value of customers across the user journey.

100M+ global users

12,000+ financial institutions in 17 countries

8,000+ digital finance apps and services

Connect to a growing network of 100+ million users

Plaid enables you to tap into the industry’s largest network of banks, fintechs, and consumers. So you can onboard new customers, reduce fraud, and increase the lifetime value of customers across the user journey.

100M+ global users

12,000+ financial institutions in 17 countries

8,000+ digital finance apps and services

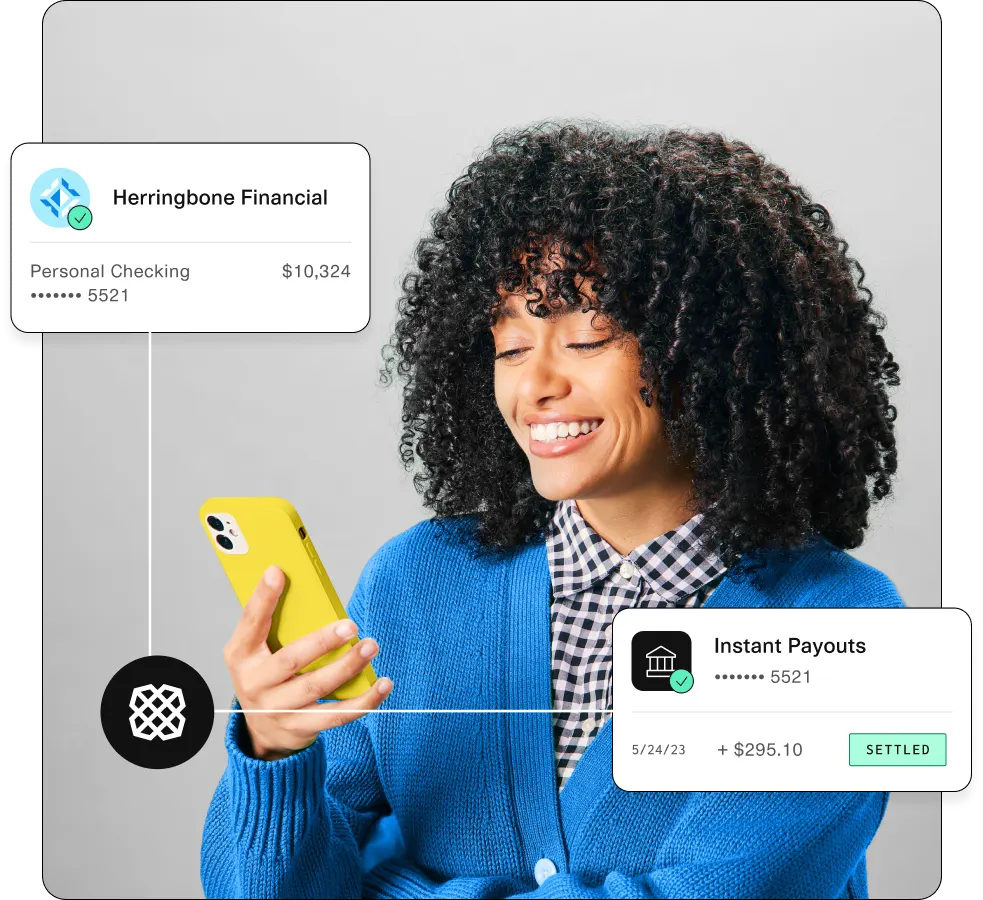

Meet customers where they are regardless of where they bank

With more data connections and the ability to verify depository accounts from any US bank, Plaid makes it easier to reach more customers than ever.

Verify 16,000+ ID types from 200 countries and territories

Verify income for almost 100% of the US workforce

Provide 100% account coverage for same day and standard ACH

Enable instant payouts for 65% of US consumer accounts

Meet customers where they are regardless of where they bank

With more data connections and the ability to verify depository accounts from any US bank, Plaid makes it easier to reach more customers than ever.

Verify 16,000+ ID types from 200 countries and territories

Verify income for almost 100% of the US workforce

Provide 100% account coverage for same day and standard ACH

Enable instant payouts for 65% of US consumer accounts

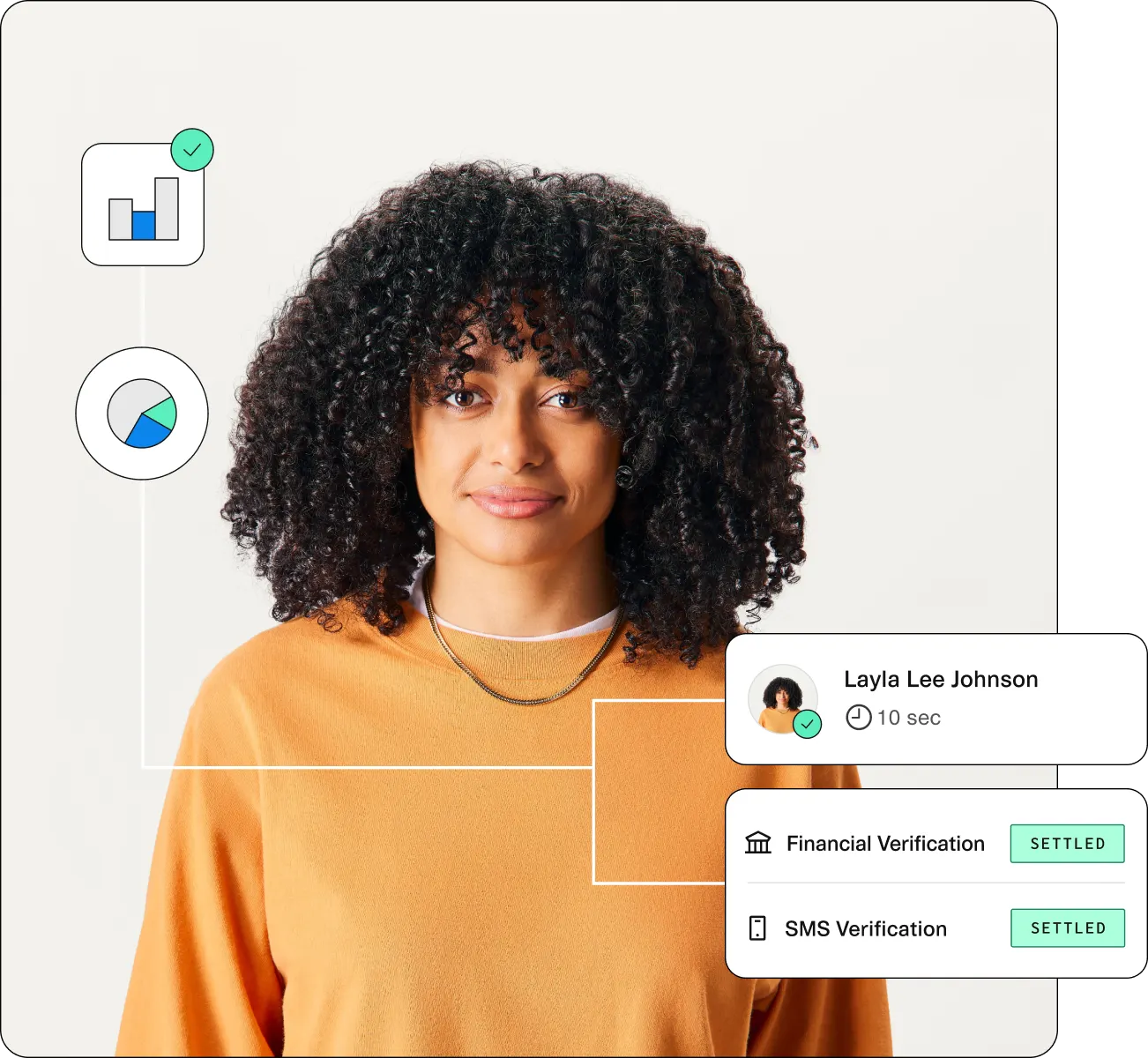

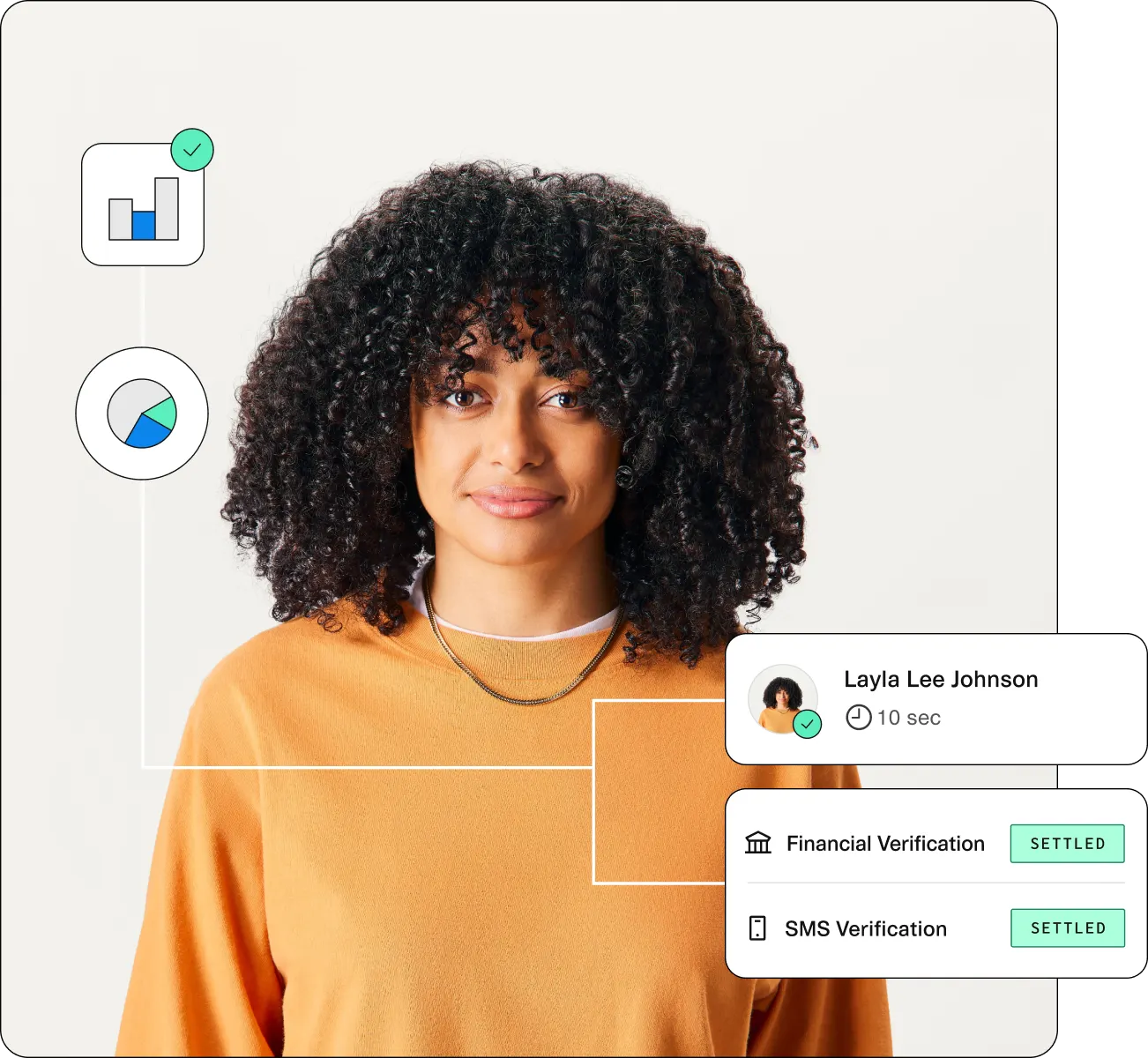

Onboard 15% more customers, then keep them coming back

Plaid leverages deep and rich data to personalize the user experience and make it easier for customers to verify their end users’ identity and securely link their accounts.

Verify identities in as little as 10 seconds and 50% faster for customers who save their data on the Plaid Network

Enable customers to link their financial accounts to your app in as little as 7 seconds

Boost conversion even more with Plaid's returning user experiences

Onboard 15% more customers, then keep them coming back

Plaid leverages deep and rich data to personalize the user experience and make it easier for customers to verify their end users’ identity and securely link their accounts.

Verify identities in as little as 10 seconds and 50% faster for customers who save their data on the Plaid Network

Enable customers to link their financial accounts to your app in as little as 7 seconds

Boost conversion even more with Plaid's returning user experiences

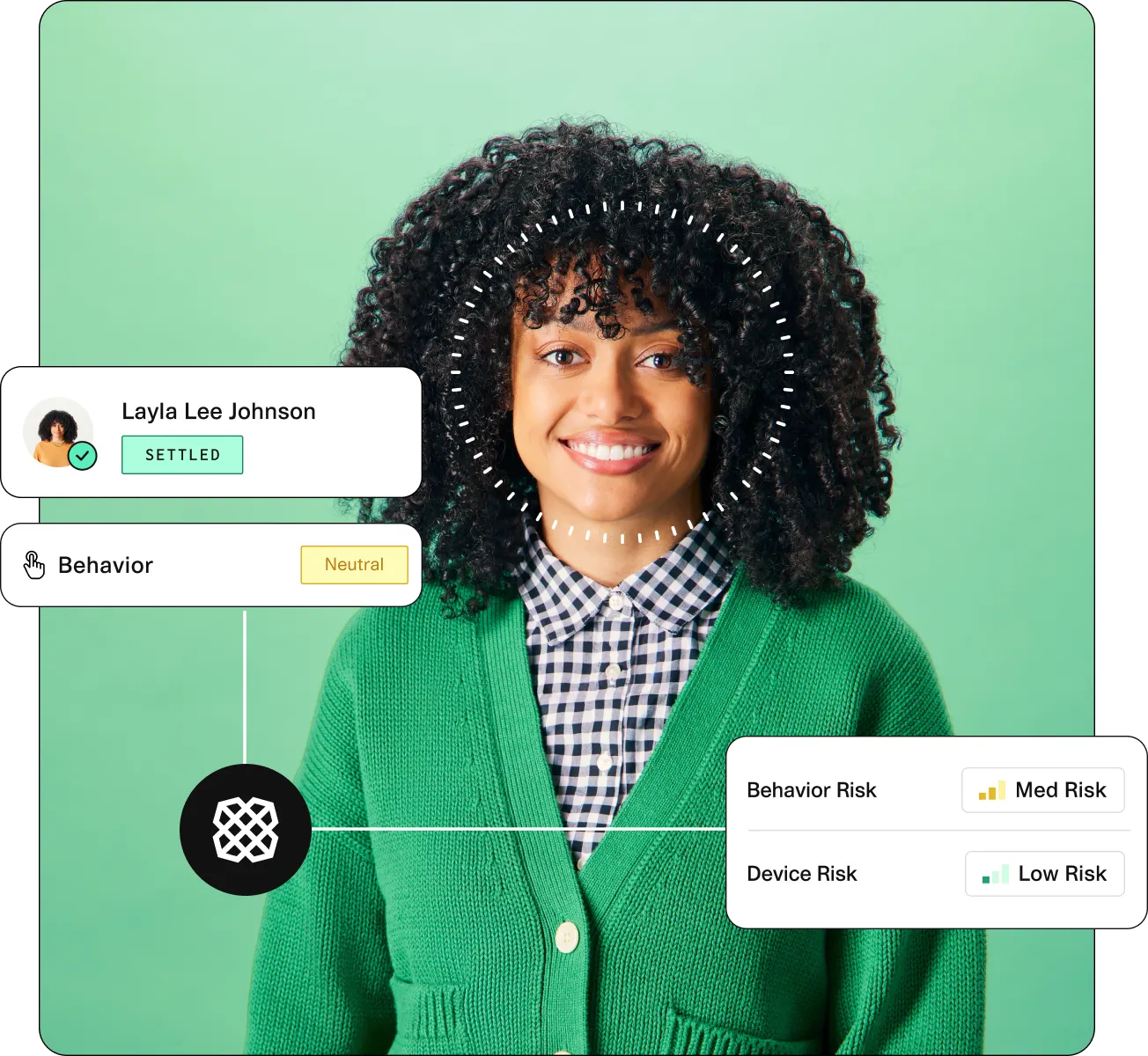

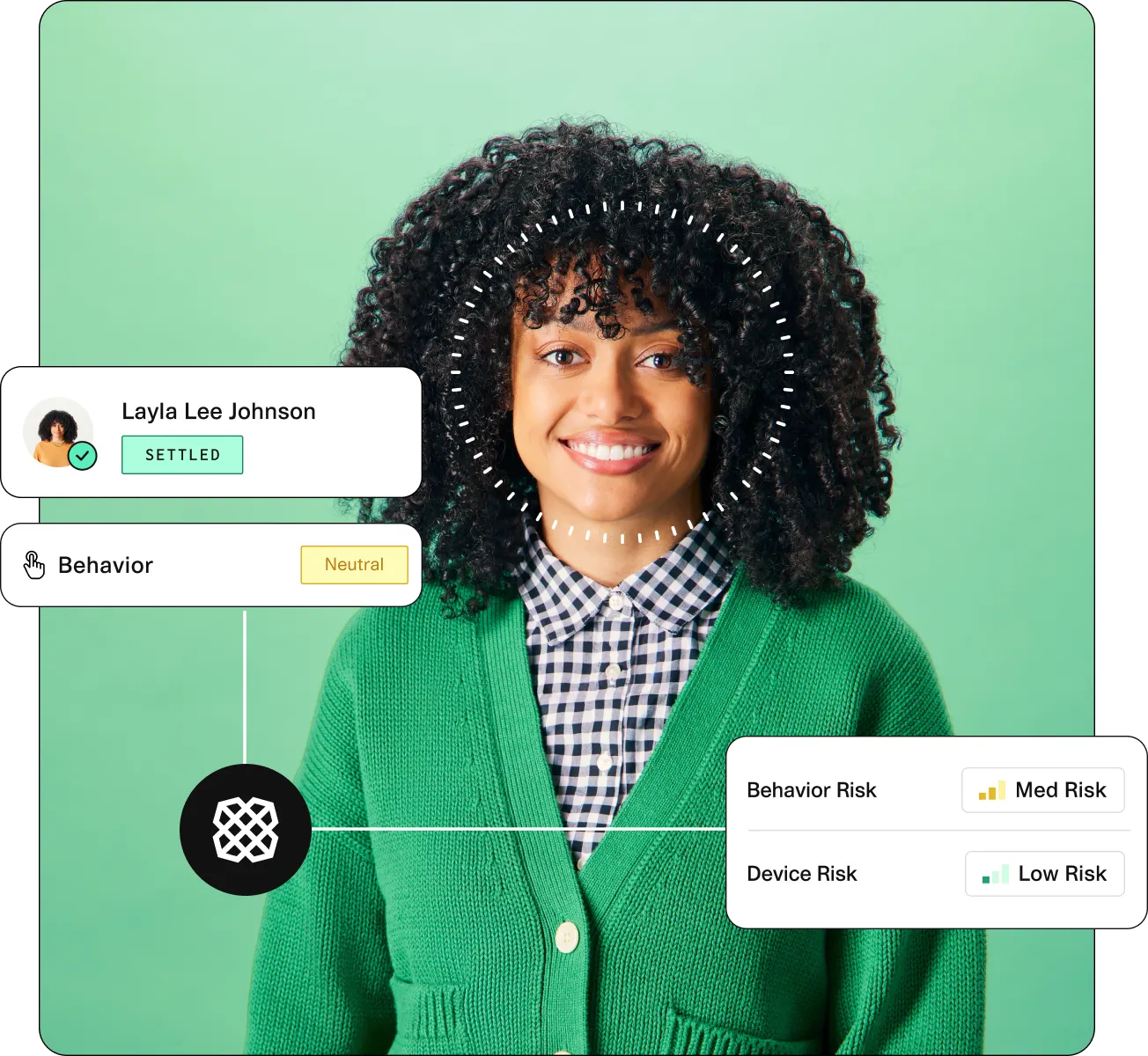

Stop fraud earlier and faster with better data insights

Plaid uses advanced machine learning to help businesses make better risk decisions, improve the customer experience, and fight fraud at every stage of the customer journey.

Analyze 100+ risk signals to assess risk and stop stolen identity, synthetic identity, and account takeover fraud

Evaluate ACH return risk using 1,000 risk factors and over 60 predictive insights

Enhance your risk program at scale with insights powered by machine learning

Stop fraud earlier and faster with better data insights

Plaid uses advanced machine learning to help businesses make better risk decisions, improve the customer experience, and fight fraud at every stage of the customer journey.

Analyze 100+ risk signals to assess risk and stop stolen identity, synthetic identity, and account takeover fraud

Evaluate ACH return risk using 1,000 risk factors and over 60 predictive insights

Enhance your risk program at scale with insights powered by machine learning

Trusted by 8,000+ leading brands

More companies trust Plaid to protect user data than any other platform

Privacy

Millions of people trust Plaid with their sensitive financial data. That’s why we only share the financial data needed to power the apps they use or to protect them and the Plaid Network from fraud.

Learn more

“With Plaid, we’re able to build trust and security directly into our experience.”

MaryAlexa Divver, Head of Product, Infrastructure & Assets at Public

Security

Plaid’s security is always evolving to meet or exceed rigorous industry standards. We also protect user data with fraud detection technology and tools like envelope encryption.

Learn more“...we’ve always put security and compliance at the forefront. Plaid is an essential part of that work.”

Christopher Adjei-Ampofo, Chief Information Officer at Uphold

Transparency

Everyone has a right to control their financial data. That’s why Plaid leads the industry in building practical tools that give users meaningful insights and control over the data they share.

Learn more

“Honestly, it’s like a green light. When I see that they’re using Plaid, it’s like okay—we can continue.”

Fintech consumer research

CUSTOMER STORIES

See how Plaid powers

companies of all sizes