2025

Fall Product Release

New scores and updates to fuel faster, more confident decisions

A suite of new solutions powered by insights unique to the Plaid Network

devices used to connect with Plaid

daily connections to the Plaid Network

consumers who’ve connected with Plaid

Learn more about LendScore and join the waitlist

fraud prevention

The world’s best fraud risk score just got even better

Trust Index 2 (Ti2), our most advanced fraud model yet, powers Plaid Protect with user graph and transaction data to surface deeper behavioral signals and stop fraud faster.

Find fraud hidden in blind spots

Ti2 analyzes signals across users, devices, and accounts to flag unusual behavior at scale—like hundreds of connections from one account.

Assess risk via historical patterns

Transaction history helps determine fraud likelihood and find patterns linked to synthetic identities, ATOs, or first-party fraud.

Surface behavioral anomalies

User-specific baselines make it possible to flag behavioral deviations, bringing adaptive detection to every step of the user journey.

Learn more about Ti2 and join the waitlist

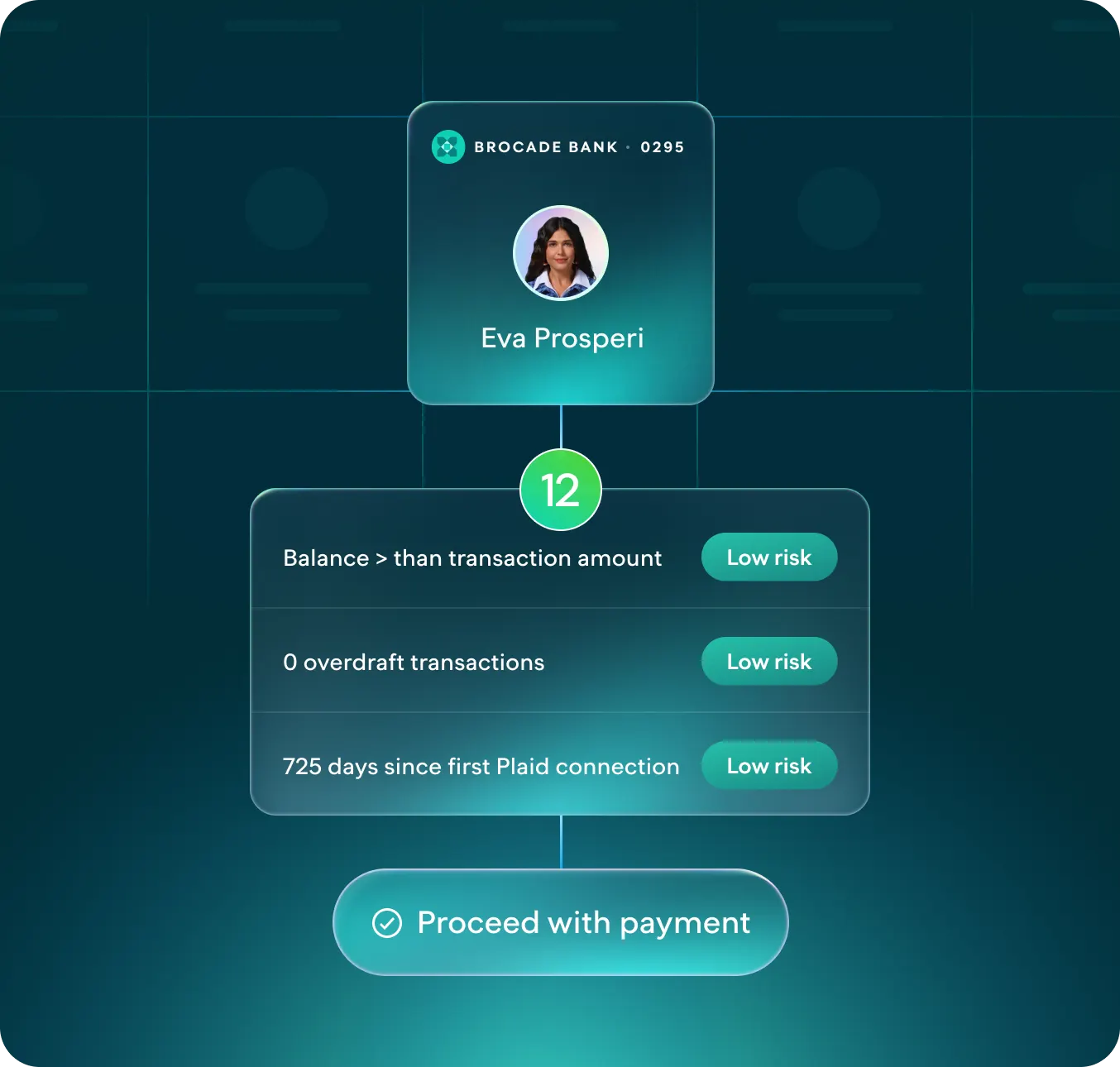

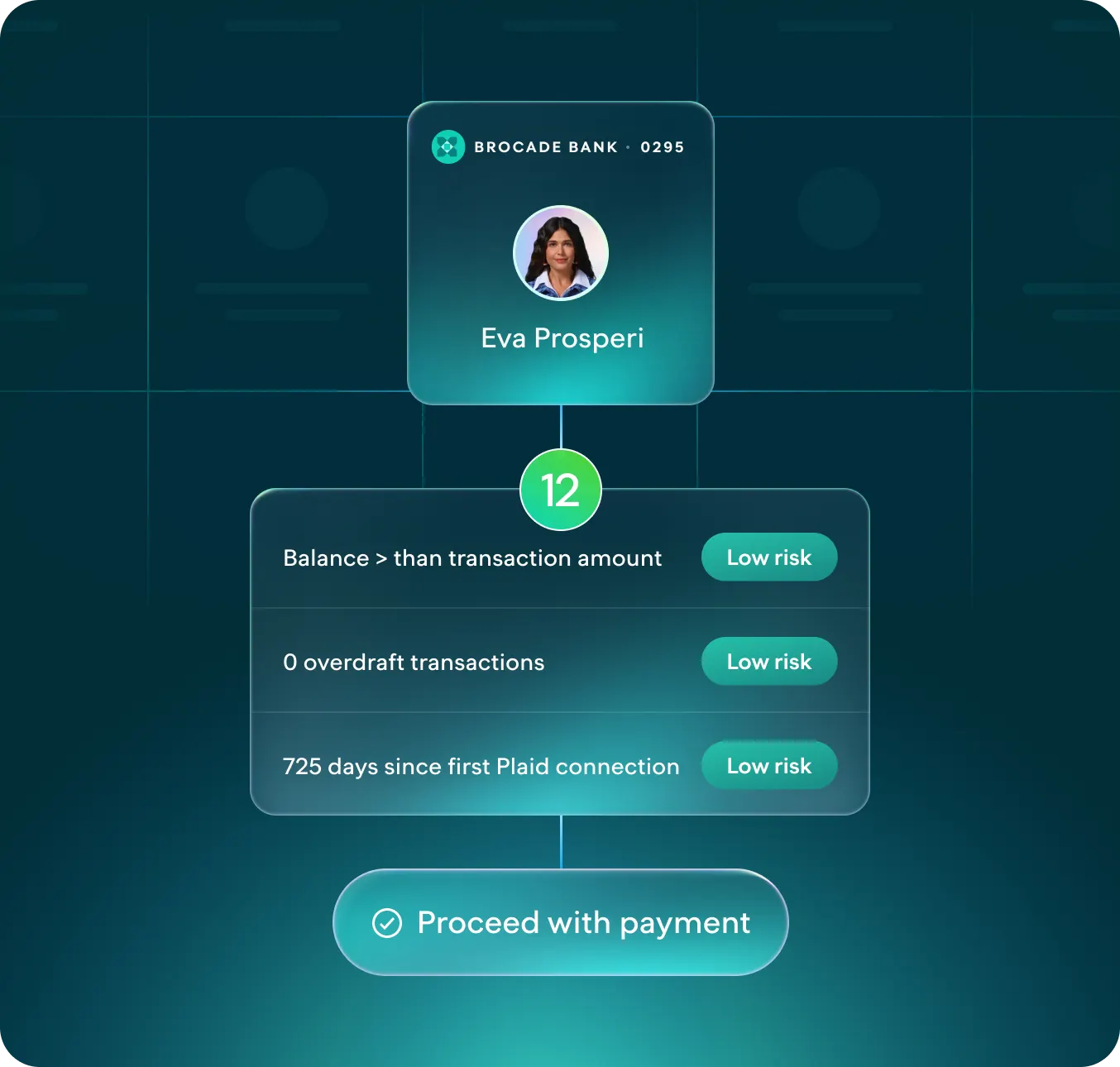

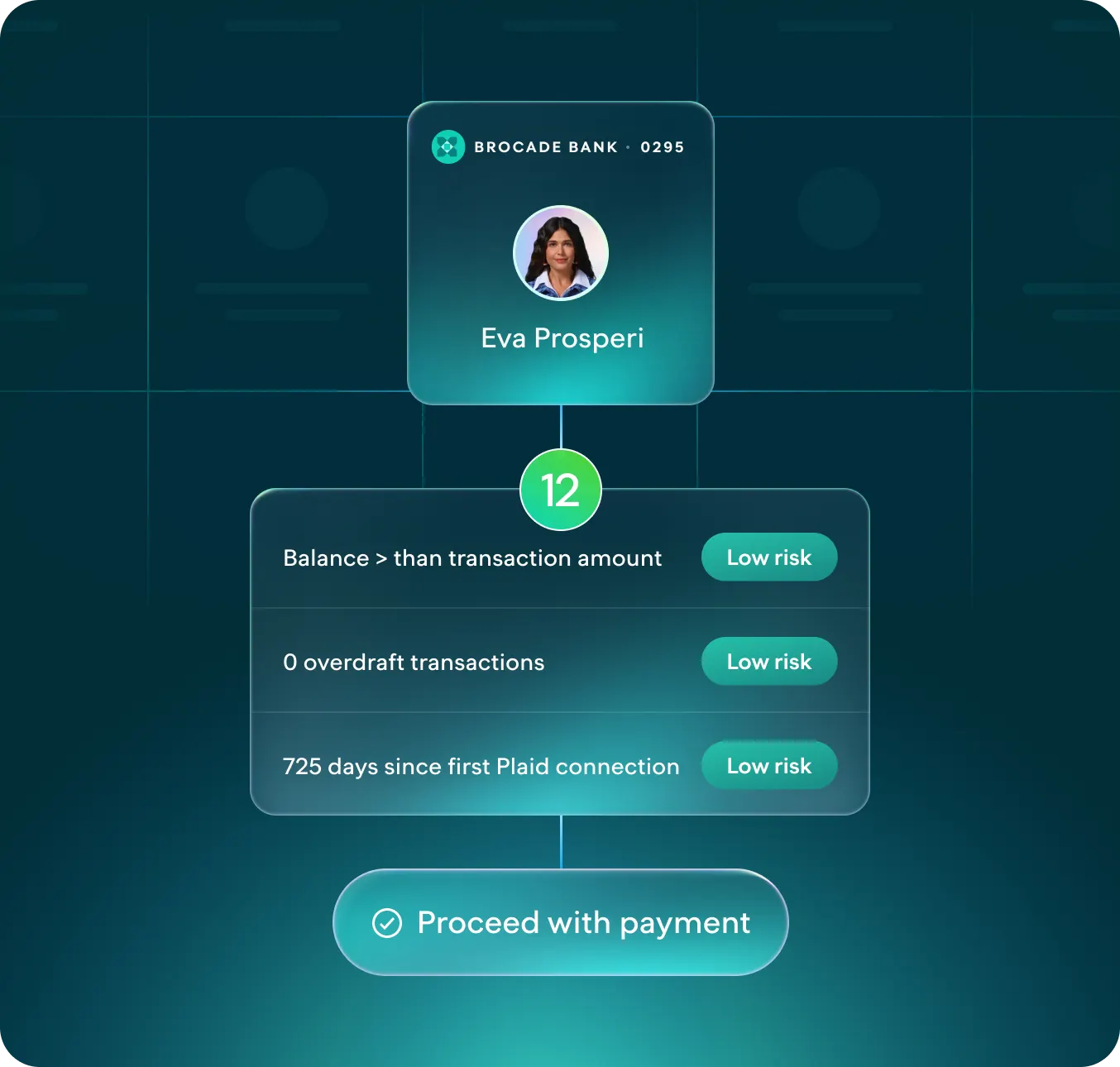

Payment risk

Transaction risk management, now even smarter with Signal

No-code rules, transaction risk scores, and now, balance checks—brought together in one flexible platform.

More successful payments, fewer returns

Manage ACH risk your way, with flexible tools, easy configuration, and purpose-built risk scores.

Built for any starting point

Start with real-time balance checks, ML-powered risk scores, or a hybrid. Signal supports whatever approach fits your risk needs.

Complete control with no code

Use our low-code dashboard to launch templates, build and refine rules, and track performance in real time—no engineering required.

Smarter models. Lower return rates.

Powered by an account’s connection history, ACH events, and identity changes across the Plaid Network, Signal’s ML models can reduce return rates by up to 40%.

Go deeper on Signal’s upgrades

Learn moreMore updates you don’t want to miss

Insights to strengthen customer relationships

Plaid Bank Intelligence is a suite of new tools to help financial institutions better understand customers, deepen engagement, and fight fraud.

Learn more about Bank IntelligenceStreamline verifications for smarter lending

Speed up workflows and cut costs with mortgage-specific verification tools powered by single-source financial data.

Explore verification tools

Instant onboarding—now for everyone

Extended Autofill can now look up and surface identity data in real-time—regardless of if a customer has used Layer already—expanding Layer’s benefits to nearly every U.S. adult.

See how instant onboarding worksNew onboarding design for higher conversion

We refined Layer’s copy, animations, and flow, driving up to 5% more users to complete onboarding.

See how Layer boosts conversion

Unlocking revenue for SaaS platforms with embedded bank payments

Transfer now supports platforms, helping you onboard customers to bank payments in minutes, and cut processing costs by up to 40% compared to cards.

Learn more about embedded bank paymentsA fresh dashboard for deeper payments insights in Europe

Europe’s new payments dashboard gives you clearer insights, real-time tracking, and streamlined reporting—all in one place.

Learn more about the payments dashboard